HIGHLIGHTS:

The S&P 500 hits new record high Tuesday and again on Friday.

U.S. economic data was healthy. Q1 GDP beat expectations.

Q1 earnings beating lowered expectations.

Week Ahead: More Q1 earnings reports, FOMC meeting and April jobs report.

The S&P 500 hits new record high on Tuesday and again on Friday.

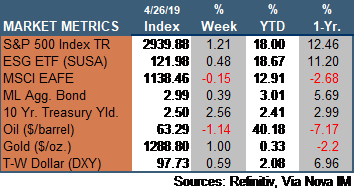

Signs of improving domestic economic momentum, and generally better than expected first quarter earnings reports helped the S&P 500 climb the proverbial “Wall of Worry” to a record high in the latest week. The S&P 500 is up 18% year to date and over 25% since the Christmas Eve low. However, economic data from the EU remained soft which weighed on foreign equity markets and boosted the value of the dollar to the its strongest level since late 2016.

The 1.2% rise in the S&P 500 was led by a rebound in health care and communication services stocks, and further broad market strength was suggested by above average gains in financial, consumer discretionary and utility stocks. Small cap stocks also outperformed the S&P 500 on signs of stronger than expected economic growth. International and emerging market stocks declined, however, on news of weaker momentum in the EU and rumors that China may cut back on its massive fiscal stimulus programs.

Bonds were boosted in the latest week by tame inflation reports. The yield on the 10-year Treasury note fell back down to 2.5%, which allowed further declines in home mortgage rates and lifted the Merrill Lynch Broad Bond Market Index by nearly 0.4%. Lower bond yields bolstered Real Estate Investment Trusts (REITS) and Treasury Inflation-Protected Securities (TIPS).

Oil prices edged lower following the year to date surge of 40%, after President Trump urged OPEC producers to increase oil output to counter declines in Venezuela and Iran. Oil and gasoline prices are politically sensitive and a focus for 2020 Presidential candidates complicating the usual supply and demand forces. Via Nova believes oil prices may be close to a peak, given the rising U.S. output, sluggish EU growth and political pressure on OPEC to increase production.

U.S. economic data was healthy. Q1 GDP beat expectations.

The latest round of economic reports showed stronger than expected growth in the first quarter and offered signs that momentum picked up in March. Via Nova believes U.S. economic momentum remains positive and that the consumer is quite healthy and able to spend supporting stronger corporate earnings in the remainder of 2019 and beyond.

First quarter Real Gross Domestic Product (GDP) rose at a 3.2% annual rate easily beating market expectations and was the best first quarter gain in four years. Moreover, aggregate inflation slowed significantly during the quarter, suggesting the Federal Reserve can remain “patient” in assessing the need for future rate increases. Healthy growth and low inflation are a favorable combination for both stocks and bonds. But while the overall pace of growth was solid, the underlying mix of components was less robust, as we expected. Inventory increases and a sharp improvement in the trade deficit were key drivers of the overall improvement. Via Nova believes the U.S. / China trade tensions have distorted normal business purchase and sale patterns and have led to increased volatility in orders, sales and inventories. A new trade deal, expected in the coming months, should help restore some stability and improve the usefulness of the standard economic reports.

Recent data suggests economic momentum is improving as we enter the second quarter. New orders for durable goods, a key leading economic indicator, rose a stronger than expected 2.7% in March, and orders for the first quarter accelerated to a 6.5% annual rate. “Core” orders, which exclude some of the more volatile sectors, rose at an even stronger 10% annual rate in the first quarter.

In addition, the recent drop in mortgage rates appears to have breathed new life into the sluggish housing market. New home sales rose more than expected in March, and the increase was the strongest March growth in a dozen years. Combined with surging mortgage applications, the available information suggests fresh momentum has returned to the sector, despite current headlines to the contrary. We pay more attention to the new home sales data for direction and momentum, because it is more current than existing home sales. New homes count as sold when a sales contract is signed, whereas existing homes are counted as sold only after closing, which usually takes months.

Q1 earnings beating lowered expectations.

First quarter earnings growth is running ahead of lowered expectations. With nearly half of S&P 500 companies reporting first quarter earnings, profits are roughly flat compared to a year earlier and to early forecasts of a 3%-5% decline. Financials, health care and consumer discretionary companies have shown the strongest growth, while energy and materials stocks experienced declining profits.

Week Ahead: More Q1 earnings reports, FOMC meeting and April jobs report.

First quarter earnings reports will continue to stream in during the coming week. The reports so far have generally been better than expected, but there have been some surprise misses. Investors will focus on the forward guidance for earnings as well as the economic outlook offered by CEOs. Given the continuing strength of the dollar, investors will also be interested in how that has impacted profits.

The Federal Reserve will hold its next Federal Open Market Committee (FOMC) meeting Tuesday and Wednesday followed by a press conference held by Chairman Jerome Powell. Analysts widely expect the Fed to leave interest rates unchanged, so the market will focus on the press conference and hints about how the Fed may adjust future policy. The Fed has already put additional rate hikes on hold for the remainder of the year, and they plan to end the portfolio drawdown by the fall – both market friendly moves. Via Nova will be watching for any hints that the Fed is worried about weak EU growth, the stronger dollar as well as the very flat U.S. yield curve, which might suggest drop in overnight policy rates in the near term. The spread between overnight and 10-year yields is close to zero, which is historically abnormal, and could suggest the FOMC may have increased rates too far last year. The 10-year Treasury yield is more determined by market forces, while short term rates are largely determined by Fed policy. Will these factors combine to nudge the FOMC in the direction of an interest rate cut in the months ahead?

If that isn’t enough information, the April Employment report is due Friday. Expectations are for another healthy gain of around 175,000 and a slight dip in the unemployment rate to 3.7%.