On February 2, 2018, the Federal Reserve took the unusual step of sanctioning Wells Fargo, citing “widespread consumer abuses and other compliance breakdowns.” In what was the last major action by outgoing Federal Reserve Board Chair Janet Yellen, the Fed took the unprecedented step of capping the asset growth of the bank and requiring it to replace three board members in April and another by the end of the year. Not surprisingly, the stock of Wells Fargo was negatively impacted. In ESG speak (Environmental, Social, Governance), this is a governance issue.

"We cannot tolerate pervasive and persistent misconduct at any bank, and the consumers harmed by Wells Fargo expect that robust and comprehensive reforms will be put in place to make certain that the abuses do not occur again," Chair Janet L. Yellen said in a press statement. "The enforcement action we are taking today will ensure that Wells Fargo will not expand until it is able to do so safely and with the protections needed to manage all of its risks and protect its customers."

A bit of background that led to this unprecedented action

On September 4, 2016, the Consumer Finance Protection Bureau (CFPB) filed a consent order against Wells Fargo after it determined it had engaged in the following practices since 2011:

1) opened unauthorized deposit accounts for existing customers and transferred funds to those accounts from their owners’ other accounts, all without their customers’ knowledge or consent;

2) submitted applications for credit cards in consumers’ names using consumers’ information without their knowledge or consent;

3) enrolled consumers in online banking services that they did not request;

4) ordered and activated debit cards using consumers’ information without their knowledge or consent.

Clients incurred annual fees and late fees, which according to some estimates, totaled $2.4 million. These unsavory practices also damaged credit scores for the affected clients. Importantly, the unauthorized use of customers’ personal information raises serious questions about the company’s general practices of data security and customer privacy.

Wells Fargo used an incentive-based compensation structure based on the number of products and services sold to customers. That structure is not necessarily a bad thing, but reports revealed that there was constant pressure from management to meet sales targets, which pushed employees to engage in these illegal sales practices. The fact that it took so long to uncover and report them, suggests a pronounced lack of supervision and compliance. After the violations were “uncovered,” Wells Fargo fired 5,300 of its retail banking employees.

On September 16, 2016, Wells Fargo announced it agreed to pay $185 million to settle the allegations with the CFPB and other agencies, but the damage to the company’s reputation, along with the financial pain, is likely far from over.

The Federal Reserve wants action

The Federal Reserve agreed that the problems went much deeper than the employees that were terminated. “The firm’s lack of effective oversight and control of compliance and operational risks contributed in material ways to the substantial harm suffered by WFC’s customers,” according to a February 2, 2018 letter from the Fed to the Wells Fargo Board of Directors. In this instance, the blame goes all the way to the top.

Wells Fargo CEO Timothy Sloan said he is committed to meeting the Fed’s concerns, but so far, numerous reports have surfaced that the bank’s attempts to rectify past wrongs have not gone smoothly. He told investors February 2, 2018 that the current estimate of the Fed sanctions would cost $300-$400 million, and the stock price fell over 5% in after-hours trading.

Some analysts contend that the bank can still be profitable near term and can work around the Federal Reserve’s constraints. Perhaps that assertion may be true, but the damage to the firm’s reputation is likely to linger with both consumers and investors. The CFA Institute conducted a survey of its Chartered Financial Analysts membership and found that board accountability was a top-rated issue when evaluating companies.

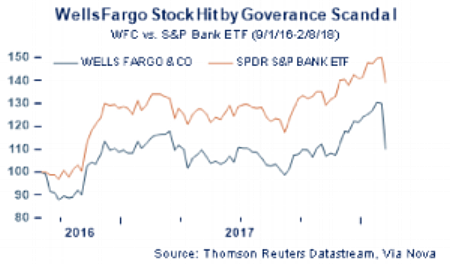

This unfortunate episode could weigh on the Wells Fargo stock price for some time. Companies and individuals rely heavily on their banking institutions and count on them to be a trusted partner. Wells Fargo’s actions were a clear violation of that trust. Investors rely on companies to generate and report accurate and legitimate income. The performance of the Wells Fargo stock price relative to its banking peers since the beginning of this scandal demonstrates the investing risks associated with poor management practices, and how investors paid the price. Wells Fargo’s governance issues has put the company in the “Penalty Box.”

Sources: Federal Reserve Board, Consumer Finance Protection Bureau, Wall Street Journal, Sustainability Accounting Standards Board, and CFA Institute.